Table of Contents:

Request More Info About 2026 NetSuite Financials Guide

Numbers, numbers everywhere, not a drop to analyze. Considering most financial departments still rely on spreadsheets for their data reports, it makes sense.

Spreadsheets have, and will continue to be (at least for the foreseeable future), a staple tool for budgeting and planning. However, it doesn’t mean businesses can’t upgrade their core software to simplify financial reporting.

NetSuite ERP is a financial software that consolidates the vital data of a company’s core processes. Its capacity to automate and integrate to a multitude of third-party applications has made it a leading Cloud enterprise resource planning (ERP) tool for the financial industry.

Its capabilities extend well beyond that of the traditional financial tool with access to a system that includes: accounting software, financial management, global business management, inventory management, order management, supply chain management, and warehouse management. These components are essential when it comes to managing a company, but when it comes to profitability and financial performance, the financial management aspect is where accountants, CFO’s, and controllers will be particularly interested.

What is NetSuite Financial Management?

As an ERP, NetSuite at its core is a financial management software. Main features include: reduced budgeting and forecasting cycle times, expedited daily financial transactions, and compliance for financial close.

Due to its accessibility in the Cloud, users are not only able to use NetSuite anywhere or anytime, but they are also able to visualize the financial performance of a business down to precise individual transactions.

The financial process of an organization is a complex one. Bank reconciliation, asset management, accounts receivable, accounts payable, revenue management - those are just a few of the responsibilities required to execute by a team of financial analysts.

Without a solid ERP in place, these assignments become a chore. Manual processes, inaccurate data entry, lack of compliance, and data inaccessibility lead to detrimental outcomes for revenue, profitability and subsequently, the business.

NetSuite financial automates these processes, provides accessible operational data, and generates quick budgets and forecasts.

Instead of groaning with each upcoming “chore”, the financial department will rave about the accelerated financial close, maintain compliance with confidence, create accurate reports, and provide the business with real-time information. All this will improve performance and produce constant growth.

NetSuite Financial Management Solutions

Behind every NetSuite ERP, there are multiple sub-tiers customized to fit the needs of each department. These categories are designed for the finance industry to facilitate daily operations. In regards to finance, NetSuite financial management software includes seven solutions for your ERP platform.

Accounting

Manage core accounting tasks: accounts receivable, accounts payable, tax management, fixed assets, and more with real-time visibility into an organization's finances.

Billing

Avoid the dreaded follow-up call for missed payments with consolidated invoicing, automated processes, and set up recurring billing with automatic renewals.

Planning and Budgeting

The ultimate solution for NetSuite planning and budgeting. This scalable and collaborative solution can approve workflows and reporting across departments.

Revenue Recognition

Time, there’s nothing more important. Unless you’re in accounting and you have specific standards to account for. Simplifying revenue recognition mandates on standards like ASC 606 and IFRS 15, no matter the type of obligation.

Financial Reporting

NetSuite financial reporting provides a birds-eye view of your business. Role-based dashboards, reports, tailored KPIs, and detailed insight into company performance for prime decision-making, are all available in financial reporting and statements that also keep up with compliance and accounting standards.

Financial Consolidation

Avoid manual data entry like the plague with a centralized financial system that automates accounting processes, reporting, and data. Even if your business has multiple subsidiaries and located across the country.

Governance, Risk, and Compliance

Never stress over audits or manual mistakes in compliance and risk management. Netsuite financial accounting software offers solutions to control governance, risk, and compliance programs within an organization.

NetSuite Financial Modules

NetSuite financial customizations are available for customers who wish to enhance their ERP. Located in the NetSuite marketplace, many third-party applications, modules, and customizations are offered to users looking to personalize their software for their specific needs and requirements.

Financial Management

Never stress over audits or manual mistakes in compliance and risk management. Netsuite financial accounting software offers solutions to control governance, risk, and compliance programs within an organization.

Dunning Letters

A streamlined and automated process that includes an accessible dashboard with information on all current accounts. This is crucial in cutting-out unnecessary errors made by manual data entry.

Fixed Assets

Keep track of a company’s fixed assets by integrating asset management with accounting and avoid the use of multiple spreadsheets, which often leads to manual error.

OneWorld

Streamline the financials of your global business, from taxation rules to multiple currencies. Get complete visibility across your business with access to finances, customers, and data from all subsidiaries.

Incentive Compensation

Track the earnings on bookings, invoices, and have the option to payout as cash is collected. Additionally, you can track the sales earned by each individual on your team without spending unnecessary time on manual calculations.

Spreadsheets for Financial Reporting

Over thirty years ago, Geoffrey Moore published his groundbreaking work “Crossing the Chasm” which described the difficult challenge in winning over the everyday customer’s adoption of new technology (“Early Majority”).

Today, the majority of leading-edge businesses running in the Cloud with enterprise solutions like NetSuite ERP, still have not crossed the chasm from financial spreadsheets to better financial planning and budgeting technology.

Although it's true spreadsheets have come a long way in the last 40 years with improved Cloud capabilities and enhanced features, at their core, customers still face many of the same challenges they always have.

The fact is, despite these shortcomings, finance folks have not given up their love-hate relationship with spreadsheets.

Financial Analysis in Spreadsheets

For FP&A professionals, spreadsheets for budgeting and planning have become the go-to solution in building, analyzing, and sharing financial budgets and plans driving the businesses they serve.

Although most organizations focus primarily on the sum of annual budgets and monthly financial processing, many businesses require the flexibility to perform quarterly re-forecasting, weekly sales reporting and other financial operations which necessitate highly adaptable tools to accommodate the unique finance needs of their business.

Consequently, with 93% of finance teams still working with spreadsheets, the pioneering “Killer App” still dominates the FP&A world providing unlimited flexibility and possibilities to dig into the details driving financial decisions.

Is it possible to move beyond spreadsheets?

Although spreadsheets deliver an ideal platform to support the art of budgeting, forecasting and analyzing financial data, with flexibility comes the trappings of data integrity and security.

The wrong formula, corrupted data, a misplaced decimal point, and poor permissions can all result in many expensive hours of valuable effort to fix these unfortunate common problems plaguing a company’s financial spreadsheets.

That being said, although NetSuite planning and budgeting software can offer a better controlled platform for your finance team, these solutions do come at a premium and may limit the flexibility necessary to adapt to your unique business needs.

Moreover, for smaller organizations that lack both resources and processes, spreadsheets dominate their world providing the best bang for their buck in financial analysis.

The Challenges of Financial Reporting in Spreadsheets

For finance professionals married to their spreadsheets, one of the biggest challenges they face is the effective capturing of Actuals locked in their Accounting and ERP systems.

Accurately pulling from their GL the posted revenues and expenses driving budgeting and forecasting data is a painstakingly manually-intensive and tedious task prone to errors.

Historical data is key to financial planning and analysis, and for the FP&A team the quality of their work is highly dependent on the data input from these critical financial systems.

Synching NetSuite and Spreadsheets

For those on NetSuite ERP, exporting Actuals to a spreadsheet can be accomplished via CSV extracts from customized Saved Searches.

It’s not uncommon for NetSuite FP&A users to adopt a “swivel chair” strategy, regularly copying and pasting CSV data into a master budgeting and forecasting spreadsheet. Shared with the finance and sales teams, this often leads to their valuable spreadsheets failing at the most inconvenient times.

Fortunately, there are spreadsheet plugins and solutions that alleviate this issue by delivering automated synchronization with NetSuite. That being said, a more controlled integration between NetSuite and spreadsheets can deliver great value to a finance team ensuring they’re getting the most accurate data from their ERP system critical to their financial analysis.

NetSuite customers can improve their financial spreadsheets by considering the following strategies:

Leverage Saved Searches for export

In an ideal world it is best to capture all raw data sets in a single search to easily extract and copy into a master financial planning spreadsheet.

Minimizing searches and capturing raw data will ensure an easier feeding of NetSuite actuals. In many cases, multiple saves searches will need to be generated to extract all the required data due to the limitations of joining tables.

Fortunately, there are NetSuite budgeting applications in the marketplace that can facilitate this process.

Build a cadence strategy to synchronize data

Implementing a set schedule, the finance team should adhere to updating the spreadsheet data from external systems to ensure consistency, data integrity and accurate versioning.

This process can be achieved manually by the designated owners of the spreadsheet, or even better, automatically via a NetSuite solution that can synchronize data more consistently and frequently.

Standardize spreadsheet templates

The development of financial budgeting, planning and forecasting spreadsheets can go in a million directions. Sitting down with the team and defining the goals, design, and audience are as important as the data itself.

It’s important to consider external data sources as part of this design that will heavily impact the usability and performance of the spreadsheet.

Clarify formulas where possible

One of the biggest culprits in a corrupted spreadsheet can be formulas and Macros. As a best practice, simplify formula creation and document their use and changes.

Moreover, raw data from NetSuite will minimize the complexity of formula management from the separate systems feeding financial budgets, plans and forecasts.

Implement Cloud-based spreadsheets for collaboration

One of the advantages of a Cloud-based solution is the ability to optimize permissions, sharing, and versioning of data.

A Cloud-based spreadsheet, such as Google Sheets, can be an excellent solution for financial analysis providing a more controlled environment to share information across your teams.

GURUS Data Exporter for NetSuite

NetSuite financial software has an array of choices at your fingertips to incorporate the top customizations for your business needs. As the department of finance, it's the team’s job to keep track of all the comings and goings of the departments to maintain a solid profitability.

As an ERP, NetSuite houses the ultimate automated finance and accounting software in the Cloud. That being said - and it's no use in shying away from the subject - many individuals continue to use spreadsheets as their main source of reporting

If your business is not ready to leave spreadsheets behind, don’t worry, you can still implement the many NetSuite add-ons while continuing to use spreadsheets. Each has their advantages and disadvantages.

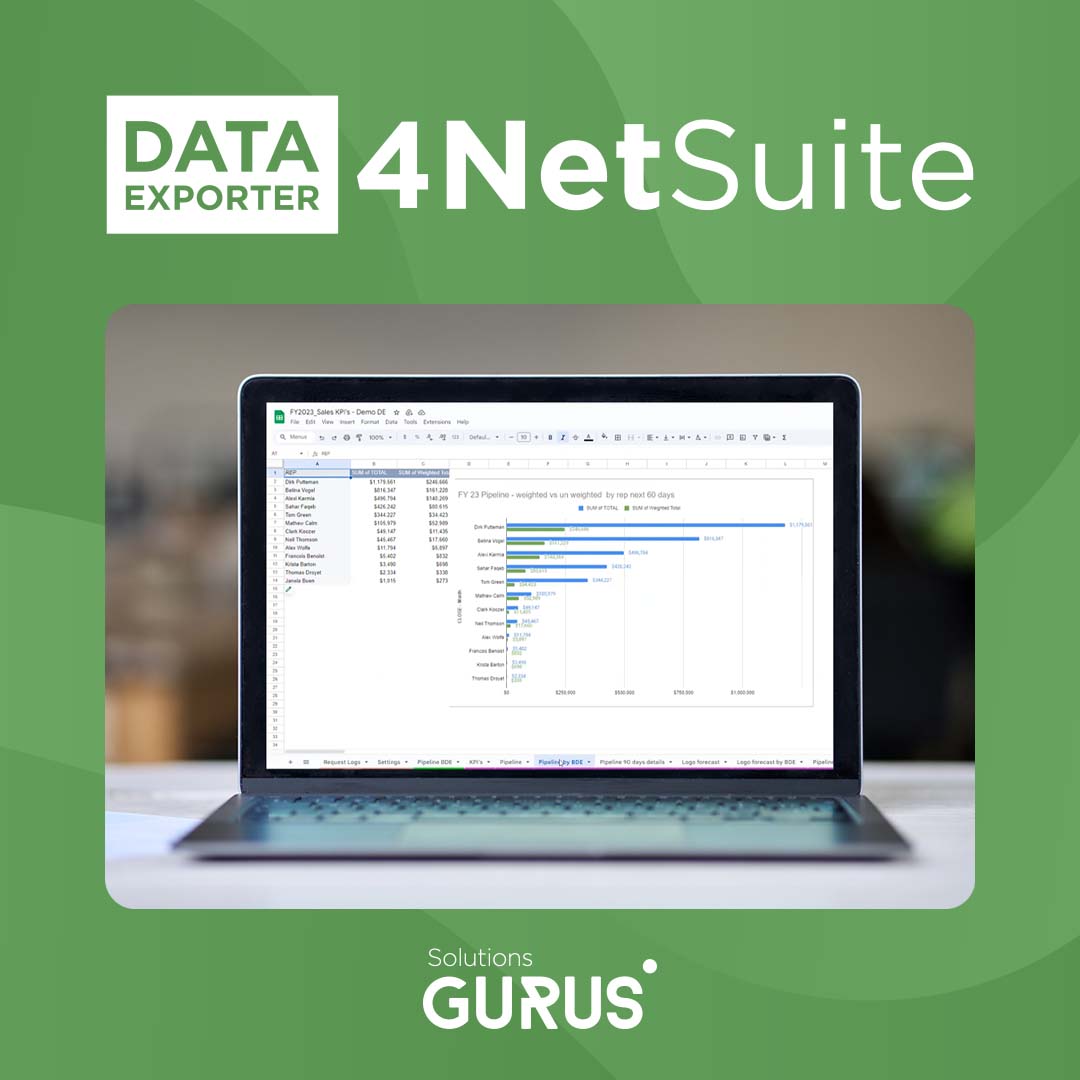

In fact, the GURUS Data Exporter for NetSuite was designed due to the ever-lingering need to hold onto spreadsheets. As easy as A,B,C, you can take your saved searches from NetSuite and export them to Google Sheets. From there, you can generate colorful charts, custom filters and formulas, and even share with clients, partners and shareholders.

As a financial department, it can be tricky to find the right tools and software to improve on tracking data, analyzing reports, and keeping up to date with the tasks at hand. NetSuite ERP offers a foundational base to automate those core processes as well as enhanced modules and customizations for your unique business challenges.

For those who can’t quite let go of those spreadsheets, there will always be a solution for that!

To learn more about GURUS Solutions, and our custom solution, check out the GURUS Data Exporter product page.

Learn More about 2026 NetSuite Financials Guide