NetSuite’s Fixed Asset Management (FAM) module offers businesses a centralized way to manage asset lifecycles — from acquisition and depreciation to disposal and reporting. Whether you’re tracking thousands of assets across subsidiaries or meeting complex compliance needs, this robust NetSuite module simplifies it all.

Without the use of NetSuite’s Fixed Assets Management (FAM) module, many clients manage their fixed assets with the use of 3rd party external systems or even Excel. When considering that a company can have thousands of assets subjected to a variety of depreciation rules, managing assets can become a headache.

Different asset types, varying lifetimes, unique depreciation methods, and tax depreciation are all examples of why managing fixed assets can quickly become a nightmare for many businesses. However, there is a simple answer to all of this: NetSuite’s Fixed Assets Management module.

Request More Info About NetSuite Fixed Asset Management Module: Features & Benefits

Key Features of NetSuite Fixed Asset Management

NetSuite’s Fixed Assets Management (FAM) module allows users to fully manage their long-term assets while accurately tracking all intricacies of the assets.

With the use of this module, running monthly depreciation is as simple as clicking a button, but also allows the freedom to only run depreciation for specific subsidiaries or asset types.

NetSuite’s Fixed Assets Management module has a plethora of additional functionalities, such as:

- Supporting various asset types

- Building compound assets

- Proposing assets directly from a standalone transaction

- Recognizing eligible transactions such as:

- Assembly Build

- Vendor Bills

- Inventory Adjustment

- Inventory Transfer

- Item Receipt

- Journal Entry

- Credit Card

- Check

- Expense Report

- Depreciating fixed assets

- Disposing of fixed assets

- Reevaluating fixed assets

- Splitting fixed assets

- Transferring fixed assets

- To another class, department, location, or subsidiary

- To another asset type

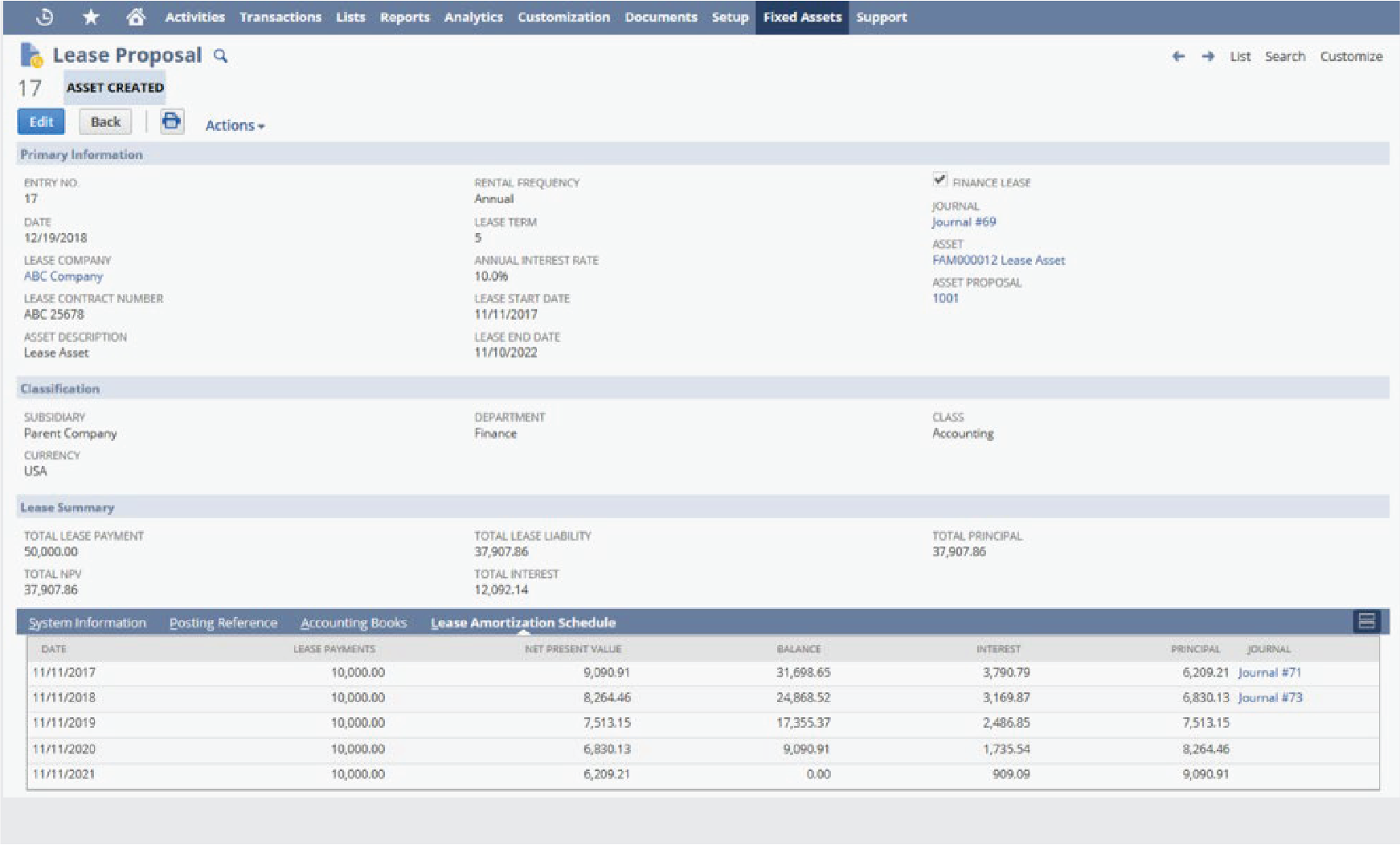

- Lease management

- FAM can generate lease schedules

- FAM can manage lease interest

- Secondary methods for tax depreciation

- Library of custom pre-built reports and saved searches

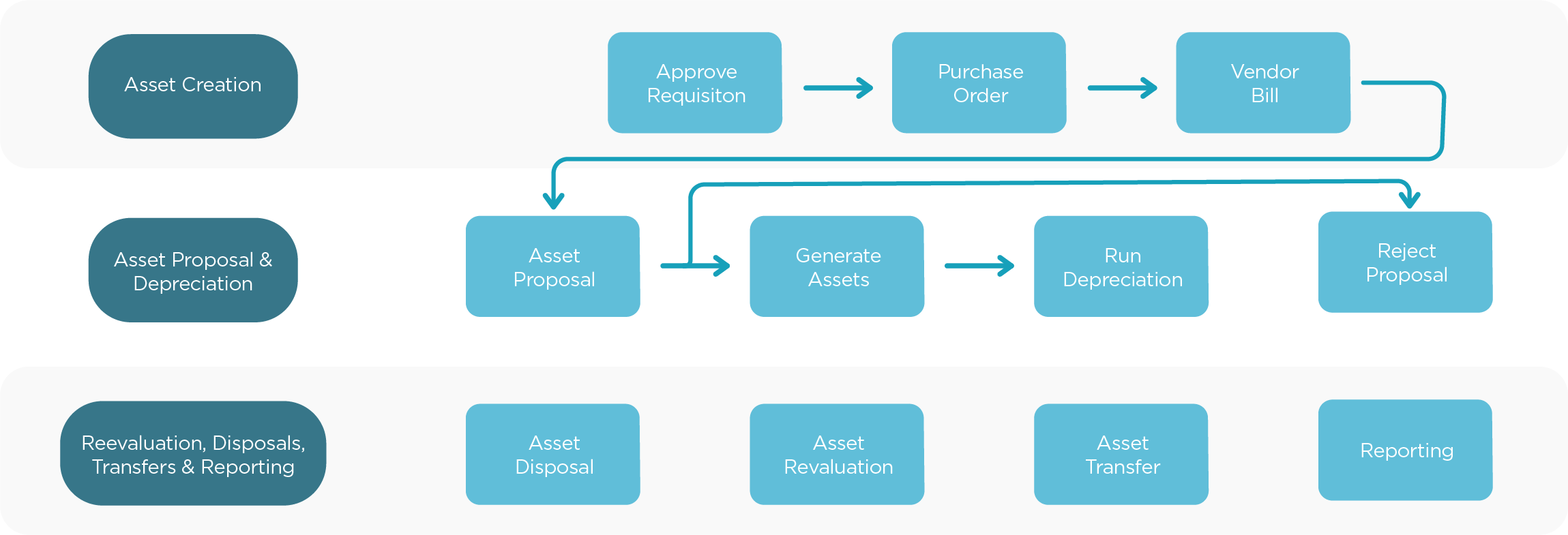

The end-to-end cycle of the creation of an asset, starting at a Purchase Requisition:

How to Use NetSuite Fixed Asset Management

Users can bring in their fixed assets via the user interface or using a CSV import. One question that is commonly asked is: Can we import mid-life fixed assets?

The answer is yes.

The process of importing mid-life fixed assets into NetSuite is quite streamlined, yet detailed.

A user would begin by importing fixed assets just like any new fixed asset into the system. Once imported, they would then simply import another CSV file containing the historical depreciation of the assets, and attach it to the source fixed asset. Assets can be brought in with as much or as little detail as the user wants.

NetSuite’s FAM also offers the ability to generate depreciation schedules for all assets automatically. If the option is set to run daily, then the system would generate the depreciation schedules for all assets overnight, as well as update any schedules daily if any changes are made to an asset.

When the imports are complete, a user can view the depreciation schedule of an asset which will show:

- An Acquisition line displaying the date and amount the asset was purchased for

- A Depreciation line displaying the cumulative depreciation between the purchase date and the date that the asset will begin running in NetSuite

- All future dated lines displaying how much that asset will depreciate in those periods

When depreciation is run for a period, the resulting journal entry will also be attached directly to that line of the asset’s depreciation schedule.

After running depreciation, assets will automatically update to show the current net book value, as well as display the most recent depreciation amount, date, and period.

Fixed assets in NetSuite can be manipulated to suit a company’s needs, all whilst keeping a trail of modifications providing clear visibility on the history of the fixed asset. With this module, it’s easy to know what the asset has done, what it is currently doing, and what it will do in the future.

FAQs About NetSuite Fixed Asset Management

Is there a limit to the number of assets that the module can handle?

There is no limit on the number of assets that a NetSuite instance can handle. However, it is important to note that there are system limitations that must be considered:

- Scripts may occasionally time out

- Saved search loading times may also reach their limit if attempting to generate too many results

Do the module’s leasing features comply with IFRS accounting standards?

Yes, NetSuite’s lease management aligns with IFRS16 and ASC842 standards regarding lease compliance.

Can I generate detailed and summarized monthly depreciation reports by location?

Yes, you can specify location, as well as other segmentation in the report filters section.

Can I create custom fields on a Fixed Assets form?

Yes, you can. You can add a field to a fixed asset form by clicking the Customize crosslink just like on any other record. You would then navigate to the Fields tab, where you can add your custom field.

What if I purchased a fixed asset on a specific date, but it only went into service a few months later?

Fixed assets in NetSuite contain various date fields living on an asset record. One field is for the Purchase Date, where the user would enter which day it was purchased. There is also a field called Depreciation Start Date, which specifies the date that the asset went into service. This is the field that would drive the start of depreciation.

Can we transform projects into Fixed Assets when they are completed?

Absolutely. Fixed Assets in NetSuite can be generated from various source transactions. If you are accumulating expenses on a project using Vendor Bills, you can generate assets directly from those transactions.

You can create an asset directly from a vendor bill. If you are accumulating multiple bills on a project, you can then create a reclassification journal entry to move the total amount of all vendor bills into the asset account. You could then generate a fixed asset using the journal entry as the source transaction.

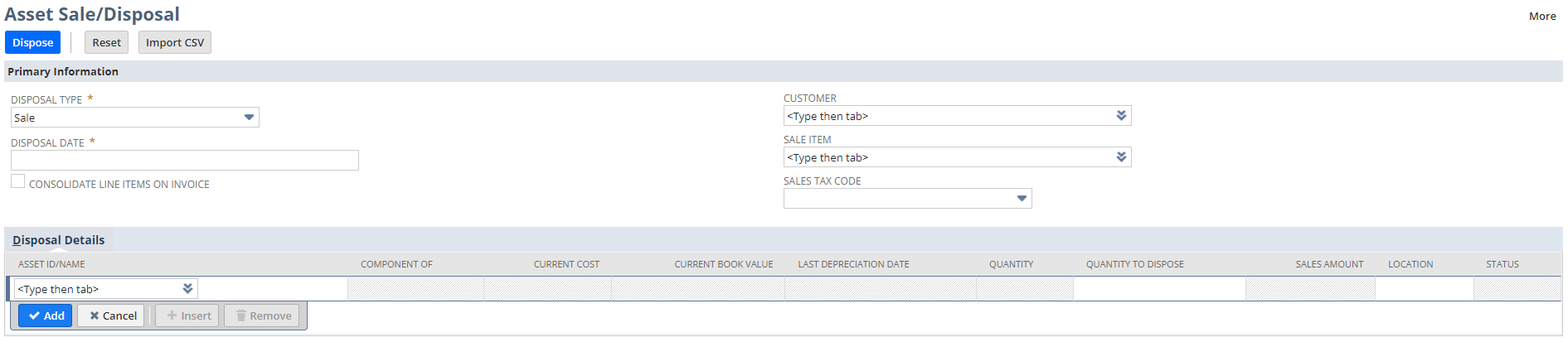

Does the module support sales taxes for asset disposals?

Yes, it does. In the Asset Disposal screen, there is an option to specify the Sales Tax Code used on the sale disposal of the asset:

Why GURUS Solutions for NetSuite Fixed Asset Management Implementation

NetSuite FAM module is a useful tool that can help you manage your long-term assets and all of their complexities on a single platform. It complies with the latest accounting standards and provides you with industry-leading reporting capabilities. However, this module is not the easiest to implement without the right partner.

That’s why you should choose GURUS Solutions, a leading NetSuite partner that has the experience, know-how, and expertise to successfully help you with NetSuite’s Fixed Assets Management. Whether you need implementation, customization, integration, or analytics, GURUS Solutions can provide you with the best NetSuite services and solutions.

Contact a NetSuite specialist today for a FREE 30-minute consultation and see how GURUS can help you transform your revenue management with NetSuite.

Learn More About NetSuite Report vs NetSuite Saved Search