Video Transcript

Manage the full asset lifecycle with ease thanks to NetSuite Fixed Assets Management. From in-service data to acquisition cost to tracking lease agreements, companies can finally stay in full control of all their financial assets.

Automated processes ensure streamlined operations with error-free records, accurate data on depreciation, and compliance for lease accounting standards.

NetSuite Fixed Assets Management is the ideal solution to stay up to date on all depreciating and non-depreciating assets. Without proper automation and accurate reporting, companies can end up over-evaluating their fixed assets, which often leads to overpaying for insurance.

Not to mention, it’s the ultimate time-saver as finance departments can finally say goodbye to spreadsheets, manual data entry, and duplicate records. Automation leads to fewer errors and more efficient processes.

Request More Info About NetSuite Fixed Assets Management

What is NetSuite Fixed Assets Management?

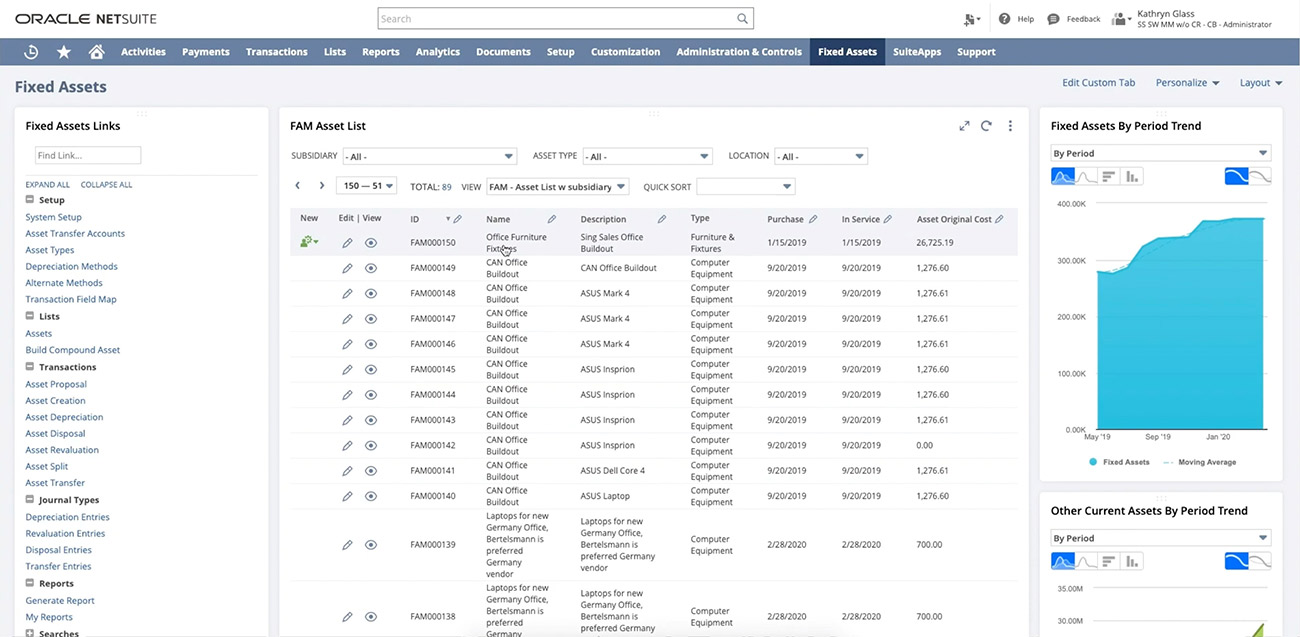

Located within SuiteApps and designed specifically for NetSuite users, NetSuite Fixed Assets Management is an automated solution for managing fixed assets, depreciation, revaluation, retirement, as well as insurance and maintenance.

Keeping track of fixed assets is particularly important for businesses as they have a shelf life of just over a year and therefore need to be monitored on a balance sheet. Especially if they depreciate year over year and need to be displayed on the profit and loss (P&L) statement for each budgetary year.

If an asset must be recorded, whether or not it’s a piece of equipment or another type or resource. It’s a requirement for any business, which is why Fixed Assets Management is so useful, as it provides a single point of reference for everything that relates to a specific asset.

Even non-depreciating assets such as software, mobile phones, or machinery can be easily tracked. For insurance, employee equipment, and maintenance schedules, having an automated application ensures all financial data is recorded and accurately monitored.

Discover The Complete Asset Management Lifecycle

The top fixed asset features are fully managed throughout the whole lifecycle: acquisition, depreciation, retirement, transfers, and revaluation. Additionally, NetSuite ERP users have access to comprehensive support, lease management capabilities, and integrations.

1.

Full Lifecycle Capabilities

For companies in dire need of a full overview and understanding of all fixed assets, it’s highly recommended to head over to SuiteApps and add NetSuite’s Fixed Assets Management.

It will track - from the moment you create a purchase order - all assets that depreciate and all the way to retirement. Whether it’s a depreciating or non-depreciating asset, the unlimited support of all asset types ensures everything is tracked.

Full customization means you can create an asset and add specific properties, key fields, and details relaying to that particular asset.

2.

Comprehensive Depreciation Support

Two options are available to users: an out-of-the-box solution or flexible features, depending on how you choose to manage your depreciation methods.

Your asset depreciation is supported by both financial records and data reporting with the freedom to create your own methods. For example: you can easily leverage support methods, including, straight line, sum of years digits, fixed declining, and asset usage.

3.

Lease Management

The majority of companies - if not all - will manage leases. This can be real estate or equipment, but whichever it is, a company must track and optimize these processes in order to have cost-effective solutions and achieve compliance.

Cloud-based ERP solutions like NetSuite offer a lease management feature to simplify amortization, reporting, tax regulations, and accounting standards.

In regards to lease administration, NetSuite’s SuiteApp gives users the ability to create, update, and track operational leases. It can also separate lease and interest expenses in order to streamline the monthly close process.

And thanks to NetSuite charts and graphics, users can leverage dashboards and reports to gain insight into all company-owned leased assets.

4.

Efficient Business Function Integrations

Thanks to powerful integrations and NetSuite’s core accounting foundation, users don’t have to worry about losing data across a highway of systems.

When creating a fixed asset from a purchase order, all asset depreciations and disposals are automatically entered into the accounting system, keeping all vital data and information in the same place.

5.

Reporting and Tracking

Finance relies heavily on accurate records in order to stay compliant and follow proper accounting procedures. That’s why detailed reports presenting the full lifecycle are a lifesaver.

Assign and track by region, facility, department, or any other segment of your choice as well as easily transfer assets from one subsidiary to another, without losing the record history. The best part? All this can be done automatically without any manual data entry.

Confusing and unexplained financial statements are things of the past because now you’ll be able to produce accurate financial reports that are compliant, meet all tax requirements, and can generate reports.

Don’t forget to also leverage other NetSuite customizations to take advantage of data slicing and dicing.

For companies with extensive fixed assets that need constant monitoring, implementing NetSuite Fixed Asset is necessary to keep track of the full lifecycle.

Accounting and finance are important aspects of a company and without proper regulations and compliance in place, trouble is not too far off.

Request More Info About NetSuite Fixed Assets Management