Use Case Scenario

In the US, contract workers or non-employees with a payment of 600$ or more (USD for services rendered during a calendar year, must provide a Form 1099-MISC Miscellaneous Income Statement for reporting tax information.

In order for vendor payments to accrue on the 1099-MISC form, you must do the following:

Setup

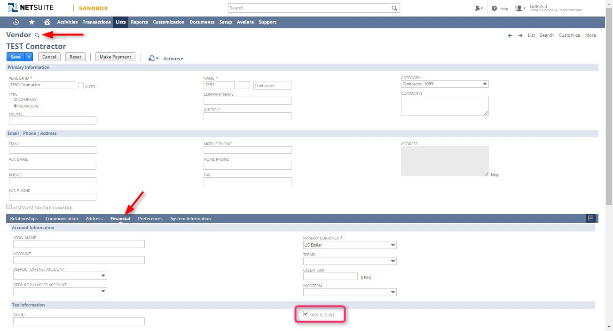

1. Vendor record → Mark each vendor 1099 eligible

• Vendor record in financial subtab, and add default expense account

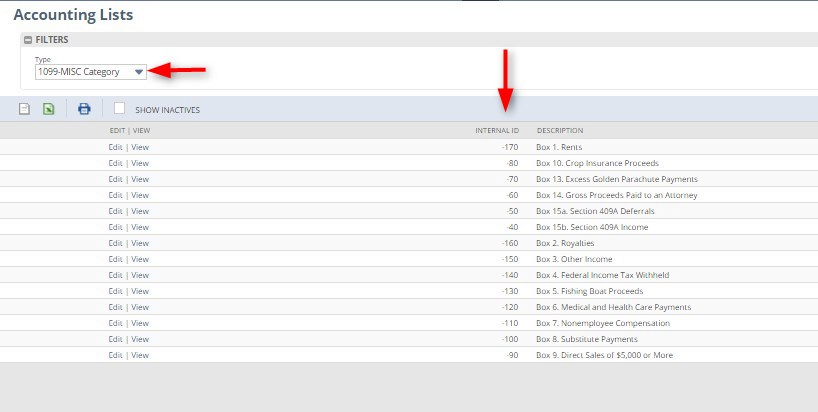

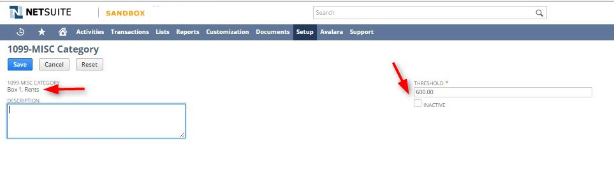

2. Account Lists → Update the threshold amounts for each category as you need, in/activate the 1099-Misc categories and add any comment

• Path: Setup > Accounting > Setup Tasks > Accounting Lists. Select 1099-MISC Category

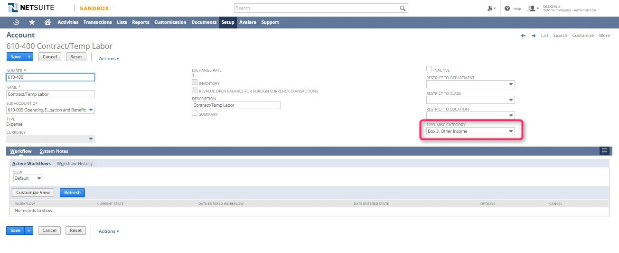

3. Chart of Accounts → associate any accounts used to track 1099-MISC expenses with the right “1099 box”

- Account categories can be used : “expense” or “other expense”

- In “1099 Misc Category” field, specify which the 1099-Misc “box” to associate with the account (only “box” per account)

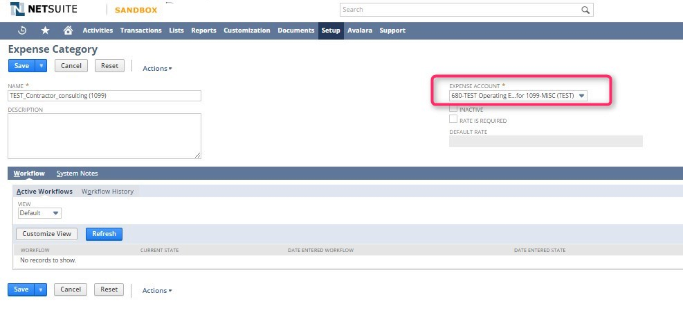

4. Accounting Expenses Categories → Link the proper Expenses Account with the Expense Category.

• Path: Setup > Accounting > Setup Tasks > Expense Categories

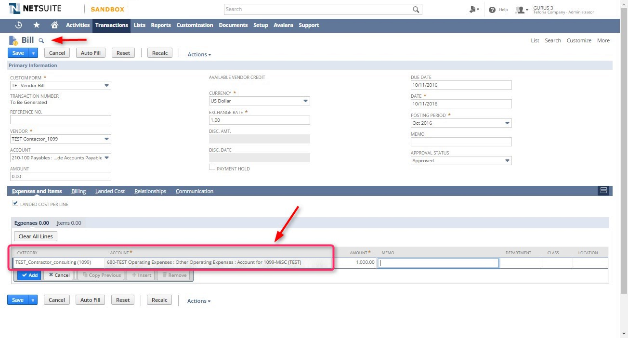

5. Vendor Bill / Sales Orders (SO) → use the right categories

6. Report → Prepare a 1099-MISC statement for a vendor

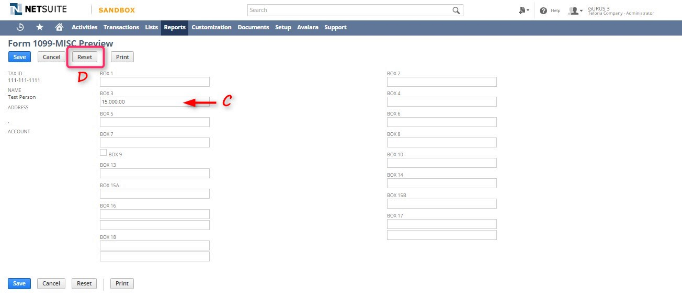

• Path: Reports > Sales Tax US > Form 1099-MISC

• Click on “Preview” to see:

• Click on “Print” to see:

Notes

- Report shows by contractors the total amount for 1099 and what has been excluded

- If some expenses billed are attached with a non-1099 account, the related amount will not been shown on the 1099-MISC form sent to the contractor, but will be shown on the 1099 report

- Only expenses can be part of a 1099-misc report (items are excluded)

- After having submitted the form, no change can be done anymore

- Any data can be overridden if you like before printing

- After having run a “1099-MISC statement” report once, you need to “reset” data (in “preview” view) it to add any additional payments done after the previous report preview

- Print PDF has to be set up using the US tax preformat