Long gone are the days of people going to a bank and depositing money or cheques into an account. Nowadays, everything is done electronically, especially when it comes to financial transactions.

Just imagine the difficulty of physically managing expenses, invoices, and revenue for a company that has offices around the world!

This is where an EFT comes in handy. An EFT stands for Electronic Funds Transfer, a type of payment done electronically. As technology advances, and we strive to have everything in one location, an EFT account is essential. It’s completely paperless and provides easy access to all accounts, financial information, and important documents.

But that doesn’t really answer the other question: what is an EFT transaction? In general terms, an EFT transaction is basically how money is spent and earned.

Request More Info From An Expert

An EFT is the electronic version of a check and is used to transfer money from one bank account to another.

No need to involve the bank as individuals or businesses can simply send the money through one place to another. It discards the use of outdated checks and paper that can sometimes take days to receive and be cleared from accounts.

For example: when you receive your salary via direct deposit, or when you schedule monthly bill payments by your credit card. When it comes to EFT in banking, the definition is simply put as the money being moved to and from different accounts, which includes both personal and business.

What is EFT in accounting?

Whether managing the finances of an individual or large corporation, an accountant has to be in control of both the accounts receivable and accounts payable. These payments are vital for survival and if mismanaged, can cause dire situations.

With the adoption of EFTs in accounting, the use for checks has since disappeared. In regards to a business, this has been a huge life saver in maintaining the flow of cash. By scrapping the wait times that come with sending in checks, clients and businesses can now easily set up automatic payments. This is especially useful when using an Enterprise Resource Planning (ERP) system as everything is digitized, leading to complete visualization of all payables and receivables.

Même en cas de retard de paiement, les comptables peuvent facilement accéder au compte avec toutes les informations et régler les factures.

What is EFT in eCommerce?

The growth of eCommerce has forced a lot of companies to adapt to the modern age and give up on outdated traditions. In particular, as these companies move beyond brick and mortar into the digital world, it’s no longer plausible to be picky with certain payments.

One thing to note is that when it comes to eCommerce, while similar to an EFT, the appropriate payment is more specific. In fact, it could even be considered as a sub-branch of EFT. It’s known as an eCommerce Payment System or Electronic Payment System.

This type of payment ties directly into another platform called Electronic Data Interchange (EDI). EDI is a platform that has computerized communication, which was originally done through paper, and automatically links data, such as purchase orders and invoices.

The most popular type of eCommerce payments are credit cards. However, alternative payments such as digital wallets like PayPal are also widely used.

What is EFT in POS?

There’s no doubt about it, we’ve all gone into a store, coffee shop, or restaurant and paid with our credit or debit card through a machine. That machine, also known as a Point of Sale (POS), is a common type of electronic payment.

While the payment terminal as mentioned above is the most common, there are many others. Software companies have expanded and now design specific POS technology for certain types of industries and organizations based on size and yearly revenue.

This EFT is widely used in brick and mortar locations and while there are still a lot of cash-only businesses, this type of payment is crucial to growth as credit and debit cards are the favored choice for financial transactions.

What are the different types of EFTs?

Direct Deposit

An EFT deposit is commonly used in the workplace and allows employers to pay their employees’ salaries electronically. In a way, it can be construed as a digital version of a paycheck.

Automated Teller Machines (ATMs)

A machine where you can withdraw and deposit money, in addition to other banking services.

Credit/Debit cards

With EFT debit and credit cards you can make payments and move money around to pay invoices.

Wire Transfers

These are most often used when dealing with large sums of money, for example, a down payment.

Electronic Checks

Quite similar to its paper counterpart, these are checks that are used to make electronic payments by including your account and routing number.

Mobile Wallets

If smart phones weren’t convenient enough, you can now make payments, add a credit card, and more.

Personal Computer Banking

All financial institutions now have online banking where you can send and receive e-transfers, make payments, and change accounts on their website.

There’s no doubt about it, the EFT network is vast and widely used among individuals and businesses to make payments easier.

The Electronic Funds Transfer Act (EFTA)

When it comes to making an EFT payment, people sometimes feel nervous. It is all done “behind the scenes” with our data being sent across the internet highway. Is it secure? What if my payment isn’t received? That’s why there’s the Electronic Funds Transfer Act, also known as EFTA.

The EFTA is in charge of security and compliance when someone makes an EFT, whether it’s error resolution, consumer liability, or identity theft. Should anything go awry, customers can sue banks or financial institutions should they break any laws established by the act.

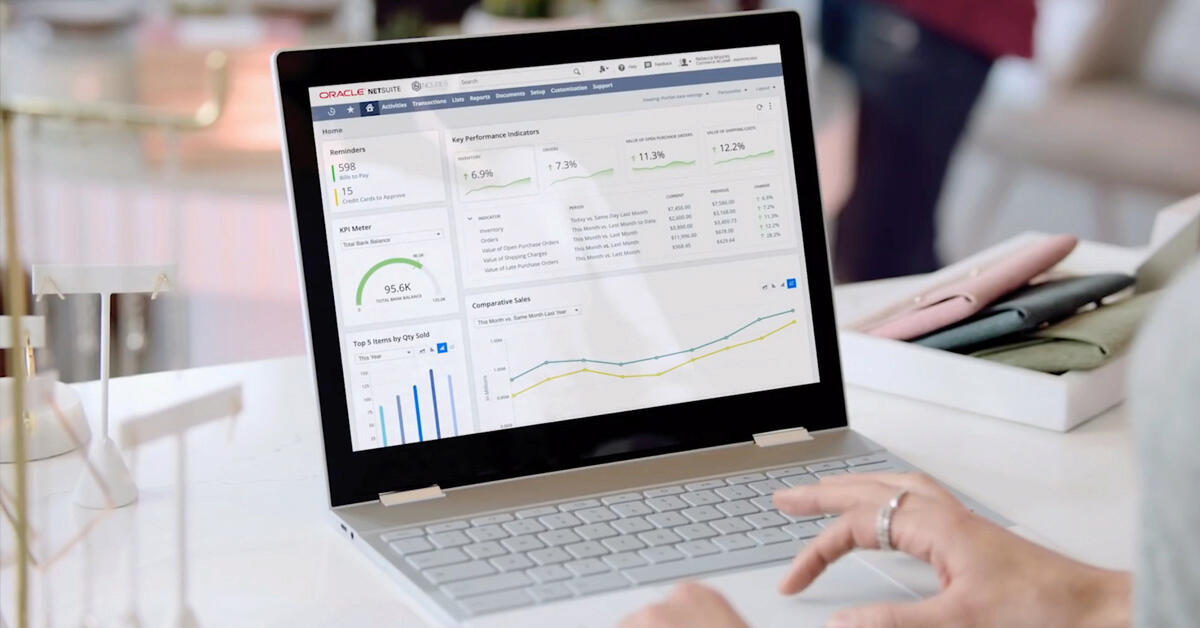

EFT in NetSuite

NetSuite is an Enterprise Resource Planning (ERP) software. As a financial solution, its capabilities can almost make a trip to the bank look archaic. From automating operations to scheduling invoices, everything is done within the Cloud, which also means electronically.

Now, when it comes to the EFT meaning in NetSuite, nothing really changes. It's the same idea, but with all the bells and whistles that an ERP boasts. All NetSuite customers have access to the EFT bundle for free.

Once installed, NetSuite will access your bank’s information in order to set up the account for future transactions. As you can with an EFT payment, you will be able to pay employee salaries and other business expenses.

NetSuite also has a high level of security and confidentiality when it comes to data. So, in addition to EFTA, you know your data is protected.

If you’re still unsure about the advantages of an Electronic Funds Transfer (EFT), watch our CEO, Martin McNicoll go into detail about EFT payment meaning in addition to its use within NetSuite ERP.

For more information about NetSuite and EFT, contact our team of experts and specialists today via our online form.

What is an EFT - Video Transcript

Hi everybody, my name is Martin McNicolll, CEO of GURUS, and today I’m going to answer the question: What is an Electronic Funds Transfer (EFT)? I’ll also explain how it works with an ERP software like NetSuite and how it can be crucial in handling your company’s financials remotely and seamlessly.

EFT is short for Electronic Funds Transfer. To put it simply, an EFT is what happens when you take money from one bank account and you send it to another, without relying on another human being to handle the transaction. Instead, a secured network is playing the role of the bank teller.

Our world runs on EFT and it includes ATMs when you withdraw money, e-transfers when you receive money from an individual and electronic bill payments when you pay your bills on your bank’s web site.

This technology is already present everywhere in our lives, but how can it improve your business operations?

EFT is not only a staple of day-to-day operations, it’s also a game-changer when you can’t go to the office anymore.

For example, your head office in the industrial neighborhood might be temporarily closed. Meanwhile, your accountant is working from their downtown condo, your CFO from their house in the suburbs, as your operations still ship from your distribution center in another city.

Using EFT automates your banking transactions in the cloud without needing a physical presence to sign cheques, approve payments, or process refunds from your head office.

You can complete these tasks remotely, wherever your office is.

Now you might ask, why do I need to incorporate EFT in my operations?

An ERP, short for Enterprise Resource Planning system, like NetSuite, includes EFT capabilities out of the box. You can automate operations such as payments and refunds, without heavy paperwork or worrying about cheque frauds. You can even schedule your operations under the security of the cloud and benefit from state-of-the-art anti-fraud tools.

NetSuite uses your own bank’s file format to transfer your banking instructions and submit the data back. This means you can pay your bills, your employee expenses, but also settle invoices from your customers under one single cloud system.

NetSuite has the tools to help you comply with payment formats to complete your operations with banks around the world, no matter the currency or the time zone.

And the best part is, if you are an existing NetSuite customer, you can install this bundle for free.

Are you interested in learning more about EFT for NetSuite ERP?

Watch our Complete Walkthrough in our Free Webinar.

For more videos and articles, be sure to subscribe to our newsletter here.